The Global Printing Press, Zimbabwe and Econet Wirelesss

Share

For a country that used to have inflation rates in excess of 10,000% just a few years ago, the forced dollarization of the country has certainly stabilized the still fragile economy that is Zimbabwe. A low base, some political and economic reforms, the formation of an uneasy coalition Government in early 2009, favorable grants from outside and a decent external environment helped the economy grow by 9.5% between 2010 and 2011. Today the local currency may be dead but the US dollar; the British Pound and the Euro have become legal tender and this has helped to bring inflation down to the mid-single digits. Make no mistake about it however; Zimbabwe remains a risky place to do business and to invest in. In terms of political reforms, the proposed new draft constitution is all about limiting the powers of the president and limiting his term in office to two and increasing the powers of parliament. Many areas of contention have however arisen over the proposed new constitution and it is as tends to be the case in Zimbabwe, likely that its implementation shall be delayed. While there is certainly a lot of pressure from the international community and the members of the SADC to have constitutional reforms and elections next year, who is likely to win these elections and what economic challenges does the country still face?

Despite what is typically written in the western media, the political fight between ZANU PF and the Morgan Tsvangirai led MDC is expected to be fierce and recent polls have confirmed that the 88 year old Robert Mugabe is gaining some ground while the MDC remains in front.

Interestingly, despite the delays and uncertainty, the global risk on environment has been nice to even Zimbabwe for rallies in cheap large cap .Considering the fact that the banking industry in Zimbabwe is in a rut with its own liquidity crisis and weak capital base, investors have been focusing on companies with solid balance sheets and with near monopolistic market shares in their respective. Ironically, the market, led by foreign inflows, seems to have figured the Zimbabwean elections out. How cheap are stocks like Econet and are they really worth the risk right now? Stocks after all are not only cheap because people have not figured it out yet but also because of risk premiums.

Interestingly, despite the delays and uncertainty, the global risk on environment has been nice to even Zimbabwe for rallies in cheap large cap .Considering the fact that the banking industry in Zimbabwe is in a rut with its own liquidity crisis and weak capital base, investors have been focusing on companies with solid balance sheets and with near monopolistic market shares in their respective. Ironically, the market, led by foreign inflows, seems to have figured the Zimbabwean elections out. How cheap are stocks like Econet and are they really worth the risk right now? Stocks after all are not only cheap because people have not figured it out yet but also because of risk premiums.

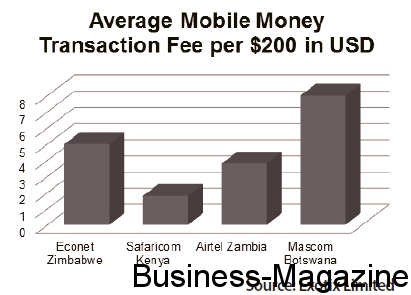

With a market cap of USD 475M and listed in Zimbabwe (where stocks are bought and sold in US dollars), Econet Wireless is by far the largest telecom operator of the country with 70% market share in the mobile segment (more mobile phones than fixed lines in Zimbabwe). Being a near monopoly in a country with some of the highest barriers to entry on the planet, it should not surprise you that Econet Wireless has some of the highest EBITDA margins in the telecoms space in Africa being second to Senegal’s Sonatel. While wage increases in the public sector may force Econet Wireless to follow suit, EBITDA margins should remain above 45% in the coming two years. The company currently has more than 7.1M subscribers and is more likely than not to reach the 14 million mark over the next five to eight years depending on the economic climate of the country.

What are the growth drivers for Econet and how easy is it for such a company to finance itself in such a fragile and volatile country? Voice services shall continue to retain the biggest share of the pie in the medium term as Econet continues to grow its subscriber base aggressively. As promotion campaigns intensify however, we would imagine that ARPUs would stabilize and even drop which shall make the company increasingly reliant on its data and mobile banking services. In terms of data, despite acute poverty, Zimbabwe ironically remains a literate state and broadband penetration stands at close to twice the Africa average at close to 20%.

What are the growth drivers for Econet and how easy is it for such a company to finance itself in such a fragile and volatile country? Voice services shall continue to retain the biggest share of the pie in the medium term as Econet continues to grow its subscriber base aggressively. As promotion campaigns intensify however, we would imagine that ARPUs would stabilize and even drop which shall make the company increasingly reliant on its data and mobile banking services. In terms of data, despite acute poverty, Zimbabwe ironically remains a literate state and broadband penetration stands at close to twice the Africa average at close to 20%.

In terms of mobile banking, Econet’s EcoCash initiative has already amassed some two million subscribers after only a year since its launch. In sum, while ARPUs in voice are expected to mature and even fall somewhat, fees from mobile banking and the growth potential in data services shall keep weighted ARPUs reasonably stable in the medium term. In terms of financing, the stock trades at a low net debt to equity of 45% and has been able to raise some 307M USD this year in debt from local and international lenders at a rate of 6% per annum. This essentially allowed the company to lengthen the maturity of its debt to five years in a country where long term financing is difficult to obtain. In terms of technicals, it is pretty obvious that investors should look for a pullback despite the apparent cheapness of the stock but in many ways this company remains an ideal candidate to play the Zimbabwean elections of 2013. Should the MDC for example manage to obtain a majority and should the military play sport, the cheapest market in an already cheap continent shall see its risk premium fall faster than you can spell Zimbabwe. It may be true that Zimbabwe has not resolved many of its political problems yet but in a world where money printing makes us all crazy for yield, even Zimbabwe is getting some investor attention these days and judging from the recent rally, many are making a bundle by investing in the riskiest investment spot on earth. Let the printing press work some more!

In terms of mobile banking, Econet’s EcoCash initiative has already amassed some two million subscribers after only a year since its launch. In sum, while ARPUs in voice are expected to mature and even fall somewhat, fees from mobile banking and the growth potential in data services shall keep weighted ARPUs reasonably stable in the medium term. In terms of financing, the stock trades at a low net debt to equity of 45% and has been able to raise some 307M USD this year in debt from local and international lenders at a rate of 6% per annum. This essentially allowed the company to lengthen the maturity of its debt to five years in a country where long term financing is difficult to obtain. In terms of technicals, it is pretty obvious that investors should look for a pullback despite the apparent cheapness of the stock but in many ways this company remains an ideal candidate to play the Zimbabwean elections of 2013. Should the MDC for example manage to obtain a majority and should the military play sport, the cheapest market in an already cheap continent shall see its risk premium fall faster than you can spell Zimbabwe. It may be true that Zimbabwe has not resolved many of its political problems yet but in a world where money printing makes us all crazy for yield, even Zimbabwe is getting some investor attention these days and judging from the recent rally, many are making a bundle by investing in the riskiest investment spot on earth. Let the printing press work some more!

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.