Challenges of investing in the African continent.

Share

Whenever we talk about any outlook for Sub Saharan African equities, we invariably have to talk about an outlook for African bond markets too for their correlations are strong on the negative side. Secondly, considering the still young pension fund industry in the continent, the reliance on foreign investment remains quite high even in the most liquid of Sub Saharan African (excluding South Africa) markets. Foreigners in turn often point to two major limiting factors when it comes to investing in African equities. The first is the issue of liquidity and the second is the issue of benchmarking.

In terms of liquidity, the Nigerian market gets daily volumes of between USD 10-16 million, the Nairobi Stock Exchange attracts daily volumes of between USD 2-4 million and the rest, well Mauritius gets volumes of between USD 500,000-USD 1 million/ day and after that, we are really talking peanuts. This is perhaps where large fund managers who decided to get onboard the Africa story got it all wrong in the first place. There was an African equity craze which started in 2006 and the likes of Investec, Imara, Blakeney, Standard Bank etc all got on board and raised a pile of money. Obviously as their funds grew in size via inflows, they increasingly had to rely on Nigerian and Kenyan equities for these markets held the most liquid stocks. The worst part of liquidity is that you feel it the most when you need to sell. Liquidity began to dry up in Nigeria and Kenya and positions could only be disposed of by a substantial drop in prices. The reality is that in Africa, you need to be nimble and large fund sizes can be quite counterproductive.

In terms of liquidity, the Nigerian market gets daily volumes of between USD 10-16 million, the Nairobi Stock Exchange attracts daily volumes of between USD 2-4 million and the rest, well Mauritius gets volumes of between USD 500,000-USD 1 million/ day and after that, we are really talking peanuts. This is perhaps where large fund managers who decided to get onboard the Africa story got it all wrong in the first place. There was an African equity craze which started in 2006 and the likes of Investec, Imara, Blakeney, Standard Bank etc all got on board and raised a pile of money. Obviously as their funds grew in size via inflows, they increasingly had to rely on Nigerian and Kenyan equities for these markets held the most liquid stocks. The worst part of liquidity is that you feel it the most when you need to sell. Liquidity began to dry up in Nigeria and Kenya and positions could only be disposed of by a substantial drop in prices. The reality is that in Africa, you need to be nimble and large fund sizes can be quite counterproductive.

Secondly, benchmarking is an issue in Africa. Many in the West love core satellite strategies and fund managers in any event tend to be remunerated based on their relative outperformance vs a predetermined benchmark. What are the benchmarks for those looking to invest in the continent? The MSCI Africa index is made up by more than 86% of South African equities and if you are interested in getting high growth, this is not the benchmark for you. The second benchmark type would be the MSCI Africa Index ex South Africa but even there North Africa (Egypt and Morocco) account for close to 50% of the index. Again, if you are looking for fast growing black Africa, this is not the right benchmark. The MSCI Frontier Africa index may try to exclude North Africa but Nigeria accounts for 70% of this index and the positions are highly concentrated around the banking space and one stock in particular, Nigerian Breweries which accounts for 15% of the index. The reality is that there are no proper benchmarks that any wise investor should use when investing in the continent and this is perhaps reflected in the heterogeneity of benchmarks (or the lack thereof) of various Africa focused funds. Too many people in our view get obsessed with benchmarking.

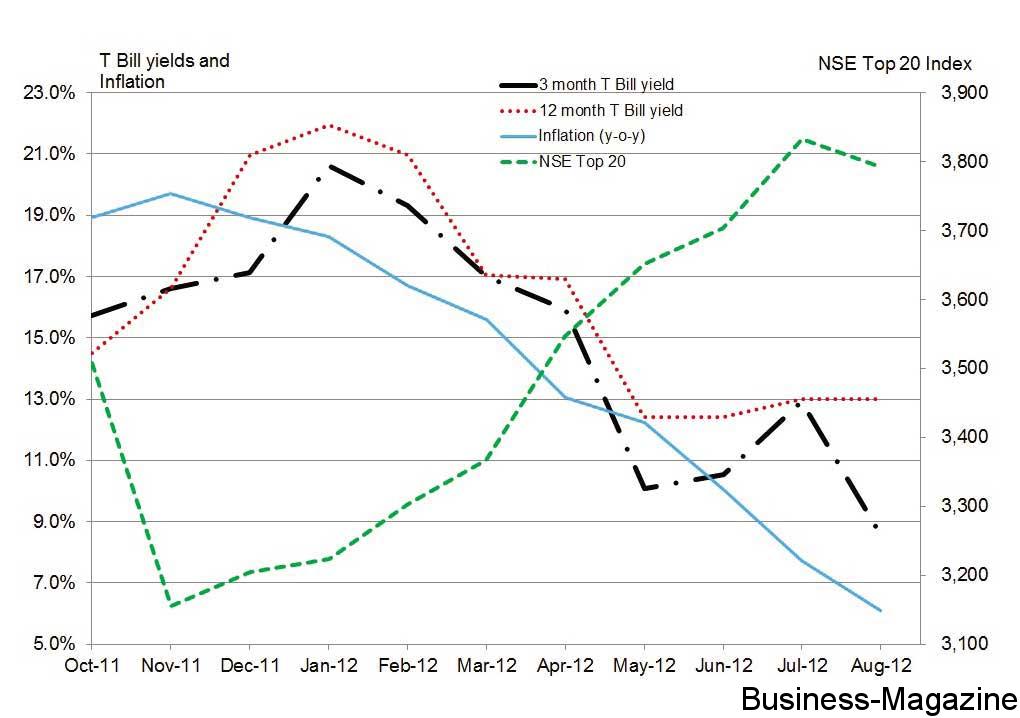

As we head towards the end of the year and after such a great year for both the Nigerian and Kenyan markets in dollar or domestic currency terms, one cannot end an article on African equities without giving an outlook for we fund managers are paid to do so. Nigerian banks which were trading at PEs of 6x after having gotten rid of much of their bad debt by selling it to the state have had a great run from a low base and the same can be said about large cap Nigerian and Kenyan stocks in the consumer, banking and infrastructure sectors as well. As inflationary pressures began to cool off this year and as central banks reached the end of their interest raising cycles accordingly, bond yields which at the most liquid part of the yield curve were returning close to 20% at a certain point in time to investors began to compress. As bond yields in Kenya and Nigeria fell, local players who were long duration made a lot of money. Nigerian and Kenyan equities are up more than 21% in USD terms this year and the large cap banks are up much more than this. What is the way forward? Nigerian banks have rallied a lot and while they are certainly not expensive by any stretch of the imagination, bond yield compression in Nigeria may have at best some 200bps left this year (compression occurs quickly in this continent and can occur within weeks) and more importantly perhaps Nigerian banks are not lending to the private sector as much for they are being quite cautious in the current global context. 2012 is simply a special year of high credit growth if you look at it on a year on year basis simply because of the massive debt restructuring exercise and risk aversion of last year as banks focused more on improving their capital base than lending. Now that the base effect is over, growth in earnings which shall remain decent (low to mid teens) will mean that the market shall not have the same catalyst as it did last year. The same story can be written about Kenya too with the likes of Equity Bank and Kenya Commercial Bank having rallied massively this year.

So how do we make money? There is a heck of a lot of short term money in these markets because locals tend to have trader like mentality and once they make 15-20%, they go back to the bond market. Use pullbacks as buying opportunities for the fundamentals over the longer term remain quite strong but do not buy the highs. Secondly, diversify into smaller markets like Ghana and Rwanda which are growing at close to 8% but understand that 2012 was a year where you could quickly make money in Africa and the future shall not be the same. In many ways, you need to have a longer term private equity like mindset while remembering that the internal rates of return on these companies is private equity like. In general, companies that have low debt and strong free cash flows such as Dangote Sugar Refinery in Nigeria remain good buys, a Mumias Sugar in Kenya which suffered from bad rains but is now recovering is where your money needs to be and the increasingly vertically integrated Zambian agricultural leader Zambeef is where you need to be while understanding that these investments shall only return handsomely in the rallies of tomorrow and not those of today.

So how do we make money? There is a heck of a lot of short term money in these markets because locals tend to have trader like mentality and once they make 15-20%, they go back to the bond market. Use pullbacks as buying opportunities for the fundamentals over the longer term remain quite strong but do not buy the highs. Secondly, diversify into smaller markets like Ghana and Rwanda which are growing at close to 8% but understand that 2012 was a year where you could quickly make money in Africa and the future shall not be the same. In many ways, you need to have a longer term private equity like mindset while remembering that the internal rates of return on these companies is private equity like. In general, companies that have low debt and strong free cash flows such as Dangote Sugar Refinery in Nigeria remain good buys, a Mumias Sugar in Kenya which suffered from bad rains but is now recovering is where your money needs to be and the increasingly vertically integrated Zambian agricultural leader Zambeef is where you need to be while understanding that these investments shall only return handsomely in the rallies of tomorrow and not those of today.

DISCLAIMER: This article is provided for discussion purposes and does not constitute, nor should it be construed as, an offer, solicitation, advice or recommendation to buy, sell or hold any securities or to employ any investment strategy discussed herein. Readers should seek professional advice regarding the suitability of any securities or investment strategies referred to herein and should understand that any statements, views, opinions, outlooks or forecasts made herein may not be realised.